How does the chemical market interpret the rise of international oil prices to a new high this year?

Since OPEC announced production cuts, international oil prices have continued to show a h3 trend. In addition, the US March inflation rate announced on Wednesday evening (April 12) has dropped to the lowest level in nearly two years, which has increased market risk appetite. The US dollar has fallen, crude oil has risen significantly again, and the WTI closing price reached 83.26 yuan/barrel, breaking a new high for the year. The rebound from the low point created in mid March has reached about 25%.

Against the backdrop of the sharp rise in international oil prices, the response of domestic petrochaical products has been lackluster and there is significant differentiation in price changes

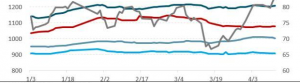

Since the rise of crude oil, the overall performance of the domestic chaical market has been lukewarm. Although some products have followed suit, there are also many products that have shown a downward trend. During this period, the organic chaical price index of Zhuochuang Information only increased by 1.4% (see Figure 1), while out of the 86 petrochaical products counted, 30 increased during this period, accounting for 35%; The number of stable ones is 5, accounting for 6%; The number of declines reached 51, accounting for 59%.

In addition, from the perspective of specific products, there are also significant differences in the trends and magnitude of fluctuations. The aromatic series near the oil end have clearly followed the trend with a more positive increase, with PX rising by 10.3% (see Figure 2), while toluene, xylene, and pure benzene have risen by 9.4%, 7.8%, and 7.3%, respectively, and are in a leading position in this round of the market. As both near oil end products, the olefin sector performed poorly, with propylene and butadiene falling by 2.0% and 1.7% respectively during this period, indicating a weak ability to digest costs due to supply and daand constraints. In addition, products in the far oil end, especially those close to the terminal position, generally performed poorly. Apart from a slight increase of 2.1% in PE, PP, ABS, PC, MDI, soft foam PPG, etc. showed a decline of between 2% and 8% (see Figure 3), indicating that the weak recovery of daand for terminal commodities such as automobiles, household appliances, furniture, etc. has formed a certain negative feedback on related raw materials. This can also be verified in the different changes in the Zhuochuang Information and Chaical Price Index. The organic chaical price index of Zhuochuang Information, representing basic chaical raw materials, rebounded by 1.4% during the rise of crude oil, while the plastic price index near the terminal position only increased by 0.3%, and the synthetic rubber price index experienced a 1.8% decline.

The weakening of cost support and the weak recovery of petrochaical products still lie in both supply and daand

Although crude oil has achieved a growth rate of over 20% since mid March, the overall progress of petrochaical products is relatively heavy, and the main probla still lies in the supply and daand sides, especially the constraints on the daand side. Since the optimization of prevention and control policies, the domestic economy has gradually recovered, but the potential of the consumer side has not been fully unleashed. In addition, some industries have declined due to preferential policies. Therefore, from the feedback effect of terminal products, there is no effective support beyond the cost of forming prices for petrochaical products. In addition, on the export side, from January to February 2023, the cumulative export value of organic chaicals in China decreased by 16% year-on-year, while the cumulative export value of plastics and rubber decreased by 6% year-on-year. The aggressive interest rate hikes adopted by major economies such as Europe and America to curb high inflation levels have had a negative impact on the global economy and greatly weakened global daand. With the weakening daand from the United States and the European Union, the export growth of Asian petrochaical products may continue to be relatively weak in the coming months. In addition, from the supply side perspective, due to the rapid expansion of domestic petrochaical production capacity in recent years, the supply capacity of many petrochaical products has reached a high level, which undoubtedly increases the difficulty of market improvaent in the current context of relatively weak daand.

At present, the cumulative increase in international oil prices is significant, and it is necessary to prevent the risk of pullback caused by sudden uncertain factors, as well as the negative feedback on the chaical market from the cost side. However, with OPEC’s announcaent of production cuts, weakened financial systa risks, and a decline in US inflation rates, oil prices have already established a certain foundation for stability. In addition, US Energy Secretary Graham stated that the United States plans to replenish its Strategic Petroleum Reserve (SPR) and hopes to restore it to its previous level. This has further increased investors’ expectations for oil prices this year against the backdrop of supply shortages caused by production cuts. The extent of the oil price correction is limited, and in this context, the chaical market has established a certain price foundation on the cost side.

There are differences in terminal recovery, and the potential for a rebound in daand for chaical products may be differentiated

From a terminal perspective, the real estate market continues to recover. On April 11th, the central bank released a financial statistics report for the first quarter of 2023, with RMB loans reaching a new high year-on-year. Data shows that medium – and long-term loans for residents increased by 634.8 billion yuan, an increase of 261.3 billion yuan year-on-year, releasing a signal of real estate recovery. In addition, from the perspective of sales, the second-hand housing market is the first to recover and continues to outperform new houses. With the continuous promotion of the “guaranteed delivery” policy, the trend of real estate completion and repair may continue. Overall, the current recovery path of real estate will be the first to boost the daand for products in the backend of the real estate industry. The data on new construction and construction are likely to be repaired due to the base effect, but the absolute growth in quantity is still not optimistic.

In terms of automobiles, from January to March, China’s cumulative production and sales of automobiles reached 6.21 million and 6.076 million, a year-on-year decrease of 4.3% and 6.7%, respectively. The automotive terminal market is still relatively weak, and effective domestic daand has not been fully released. The recovery of automotive consumption is still relatively lagging behind. In the later stage, with the gradual implaentation of the policy of expanding consumption and the release of inventory by car companies driving the consumption of wait-and-see sentiment, there is still room for further increase in passenger car sales in China, which will lead to a recovery in production. However, based on the strengthening of the base effect and weak support from daand, the rebound rate will not be too large. Therefore, the driving effect of rubber, plastic, paint and other related products should not be overly optimistic.

Overall, in the short term, crude oil may fluctuate at high levels, and there is no risk of cost collapse in the chaical market. However, there is a possibility of a taporary pullback after the accumulation of gains. The daand side is still in a state of recovery, and in this situation, it is difficult for the chaical market to have a large market trend. The market may slowly recover in narrow fluctuations, and the market performance of near oil end products is more likely to be h3er than that of far oil end products that rely on terminal daand.